The Emissions Trading System (ETS) is a key tool in controlling pollution and promoting sustainable development. This article provides an overview of how ETS works, its economic impact, and its challenges.

Introduction to the Emissions Trading System (ETS)

The ETS is a market-based mechanism commonly used in mandatory carbon markets established by nations. It is designed to control greenhouse gas emissions within a defined area by providing economic incentives for reducing emissions. ETS allows countries to tailor their approaches based on their specific circumstances, enabling them to achieve emission reduction targets more effectively while contributing to environmental protection.

The concept of ETS is rooted in the basic principles of the market: supply and demand. A cap is set on the total emissions the participating entities within a country can collectively release. Emission allowances, representing these emissions, are allocated as permits. Companies can reduce their emissions to save permits or purchase additional permits from others if they cannot reduce them sufficiently. As a result, ETS creates a market for emission rights, where the price of these rights is determined by supply and demand.

The concept of ETS is rooted in the basic principles of the market: supply and demand. A cap is set on the total emissions the participating entities within a country can collectively release. Emission allowances, representing these emissions, are allocated as permits. Companies can reduce their emissions to save permits or purchase additional permits from others if they cannot reduce them sufficiently. As a result, ETS creates a market for emission rights, where the price of these rights is determined by supply and demand.

Moreover, ETS is not just a pollution control tool but promotes sustainable development. By encouraging companies to seek cost-effective emission reduction innovations, ETS drives technological advancements and improves energy efficiency, helping to achieve climate goals cost-effectively.

ETS stakeholders and key considerations in stakeholder mapping (Source: World Bank Group)

ETS stakeholders and key considerations in stakeholder mapping (Source: World Bank Group)

Types of Emissions Trading Systems

Currently, two main types of ETS are widely used: the Cap-and-Trade system and the Baseline-and-Credit system.

1. Cap-and-Trade system

The Cap-and-Trade system is the most common type of ETS and has been implemented in many countries, with the European Union Emissions Trading System (EU ETS) being a prime example. This system sets an absolute limit (cap) on the total emissions all participating entities can collectively emit. This cap is divided into emission allowances, with each allowance permitting the emission of a specific unit of greenhouse gases (typically one ton of CO2 equivalent).

These emission allowances are allocated to entities either for free or through auctions. Entities can use the allowances to meet their emission obligations or sell them to other entities in the market. If an entity can reduce its emissions at a lower cost than the market price of the allowances, it can sell the excess allowances for a profit. Conversely, if reducing emissions is too expensive, the entity can purchase allowances from the market.

2. Baseline-and-Credit system

In the Baseline-and-Credit system, each participating business has a set emissions baseline determined based on its historical emissions or industry standards. Businesses can then implement improvements in their operations to reduce emissions below their baseline. The amount of CO2 equivalent reduced below the baseline is certified as credits. These credits can then be sold to other businesses or used to meet their emission obligations.

The Baseline-and-Credit system is often used in sectors that are difficult to regulate or where setting an absolute cap is not feasible. However, this system can be more complex to monitor and verify, as it requires establishing and adjusting baseline levels.

Key Design Aspects of an ETS

Cap Setting

Establishing the emissions cap is one of the most crucial aspects of designing an Emissions Trading System (ETS). This cap must be set based on long-term environmental goals and should be adjustable over time to reflect progress in emissions reduction. If the cap is set too high, it won’t create enough pressure to drive emissions reductions, whereas a cap set too low could lead to high costs for participating businesses and cause significant market volatility.

Allowance Allocation

Emission allowances can be allocated to businesses through two main methods: free allocation or auctioning. Free allocation is often used to mitigate adverse impacts on industries that are highly vulnerable to ETS, while auctioning is a more transparent method encouraging entities to reduce emissions most effectively.

The allocation method can significantly impact the economic efficiency and fairness of the ETS. For instance, auctioning can generate revenue for the government but may also increase business costs.

Monitoring, Reporting, and Verification (MRV)

The Monitoring, Reporting, and Verification (MRV) system is the backbone of any ETS. MRV ensures that emissions are accurately measured, fully reported, and independently verified, thereby maintaining the transparency and credibility of the system. MRV also plays a crucial role in detecting and addressing non-compliance, ensuring fairness and effectiveness within the ETS.

Economic Impacts of ETS

Encouraging Technological Innovation

The ETS creates a powerful economic incentive for businesses to invest in cleaner, more efficient technologies. As the price of emission allowances rises, technologies that reduce emissions become more financially attractive. This drives the development and adoption of advanced technical solutions, which help reduce emissions, enhance production efficiency, and create new business opportunities.

Market Value of Emission Allowances

The price of emission allowances in the ETS market is determined by supply and demand. When emission allowances become scarce, their price increases, motivating businesses to reduce emissions. However, price volatility can create uncertainty for businesses, particularly those that need to be more flexible in adjusting their production processes. Therefore, a well-designed ETS should include price stabilization mechanisms like price floors or ceilings.

Economic Efficiency and Environmental Sustainability

ETS is regarded as one of the most effective tools for achieving emission reduction goals at the lowest cost. By allowing businesses to determine how they comply, ETS encourages pursuing innovative and cost-effective solutions. However, the effectiveness of ETS heavily depends on the system’s design and management, from setting the cap to allocating emission allowances and implementing MRV measures.

Practical Applications and Challenges

Case Studies on ETS Around the World

The European Union Emissions Trading System (EU ETS) is a prime example of ETS’s success. Launched in 2005, the EU ETS has grown into the world’s largest carbon market, involving over 11,000 power plants and extensive industrial facilities across 30 countries. It has significantly contributed to reducing Europe’s CO2 emissions while driving technological innovation and generating billions of euros in revenue from emission allowance auctions.

However, not all ETS implementations have been successful. Some systems have faced significant challenges in design and enforcement, leading to inefficient markets that fail to meet emission reduction targets.

Current Status of ETS Development in Various Countries

European Union (EU): The EU ETS, launched in 2005, is currently the most significant and oldest ETS globally. For 2021-2030, the EU aims to reduce CO2 emissions by at least 55% compared to 1990. The EU ETS covers about 11,000 industrial plants and facilities in 30 countries, generating approximately 55 billion euros in auction revenue in 2022. However, volatile emission allowance prices and free allocations remain hotly debated topics.

China: The China ETS, which began in 2021, is the world’s largest by coverage, encompassing around 30% of the nation’s total emissions. Initially focused on the power sector, it is expected to expand to other industries. China’s ETS generated around 6 billion USD from emission allowance auctions in 2023 but faces challenges related to transparency and effectiveness.

United States: The U.S. has two primary ETS systems: California’s Cap-and-Trade and the Regional Greenhouse Gas Initiative (RGGI). California’s system, operational since 2013, covers about 85% of the state’s emissions and has reduced CO2 emissions by approximately 10% compared to 2012 levels. The auction revenue in California reached around 1 billion USD in 2023. RGGI, a coalition of 11 eastern U.S. states, is considering expanding its scope and strengthening emission reduction measures. Key challenges include harmonization across states and the allocation of free emission allowances.

South Korea: The South Korea ETS, launched in 2015, is the first national ETS in East Asia. It covers about 70% of the country’s emissions and helped reduce CO2 emissions by around 4% between 2015 and 2020. Revenue from emission allowance auctions reached approximately 600 million USD in 2023. South Korea’s ETS faces difficulties ensuring the system’s fairness and efficiency.

Canada: Canada operates a federal ETS mechanism alongside provincial systems like those in Québec and Ontario, which began in 2019. The federal system contributed to a roughly 2% reduction in CO2 emissions in 2023. Provincial auction revenue reached about 500 million CAD in 2023. The main challenge is achieving coordination and cooperation between provincial and federal systems.

Japan: Japan has implemented a carbon credit system in urban areas like Tokyo and Saitama since 2010. This system has reduced CO2 emissions by about 10% in participating regions. Tokyo’s carbon credit sales generated approximately 200 million USD in 2023. Japan faces challenges in expanding the system and aligning it with international mechanisms.

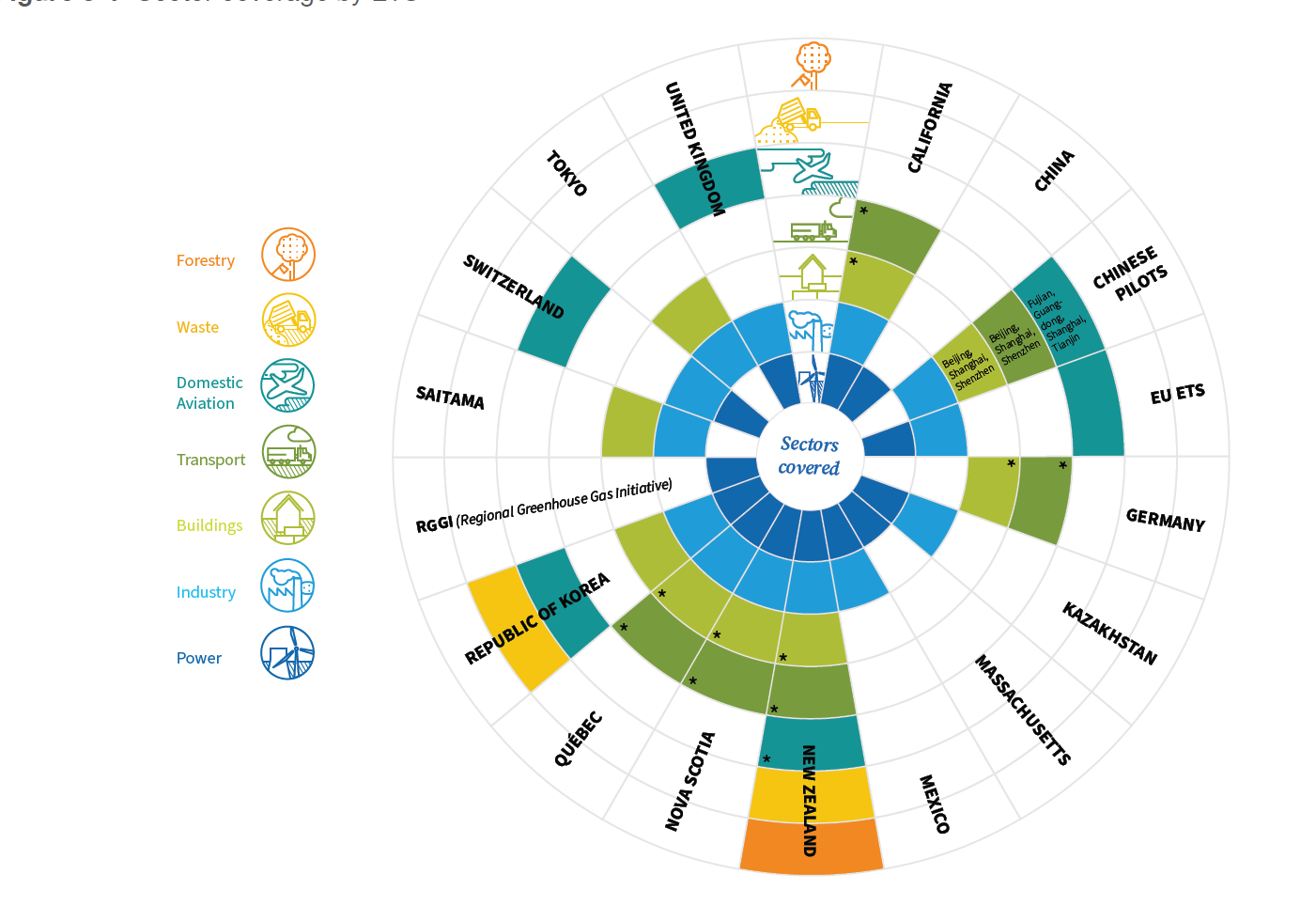

Each country will tailor its ETS mechanisms based on its specific context to cover the most suitable sectors (Source: World Bank Group)

Each country will tailor its ETS mechanisms based on its specific context to cover the most suitable sectors (Source: World Bank Group)

In Vietnam, government agencies are gradually developing a voluntary carbon credit market by introducing relevant policies, such as Decree 06/2022/ND-CP, Decision 01/2022/QD-TTg, and Circular 01/2022/TT-BTNMT, among others. Notably, efforts are to establish a pilot carbon credit market under Resolution No. 98/2023/QH15 dated June 24, 2023. For example, in Ho Chi Minh City, authorities promote green growth by building policy frameworks and action plans, which include at least three components related to the carbon credit market. Ho Chi Minh City is also committed to initiatives like developing a green Can Gio, afforestation, improving the urban environment, renewable energy, green village models, and a blue economy.

Panel Discussion: “Developing the Carbon Credit Market in Ho Chi Minh City” featured VP Carbon – Vu Phong Energy Group representatives

Panel Discussion: “Developing the Carbon Credit Market in Ho Chi Minh City” featured VP Carbon – Vu Phong Energy Group representatives

The Emissions Trading System (ETS) has proven effective in controlling environmental pollution and encouraging technological innovation. However, many challenges remain to enhance the efficiency and fairness of these systems. Countries worldwide are adopting and adjusting their ETS mechanisms to align with their specific conditions and climate goals. The future of ETS will depend on the ability of countries to reform and harmonize their climate policies.

Vu Phong Energy Group