In the context where sustainable development is becoming a top priority, businesses need to seek optimal solutions that both control costs and enhance social responsibility. Investing in solar power has emerged as a smart strategy, delivering sustainable value for both enterprises and the environment. The effectiveness of solar investment for businesses is reflected not only in financial and environmental benefits but also in non-financial advantages such as brand reputation, helping companies strengthen their image in the eyes of investors and create comprehensive value.

Overview of Solar Power Investment for Businesses

Rooftop solar is a solution that uses solar panels installed on rooftops, warehouses, offices, factories, or unused areas within a business premise to convert sunlight into electricity. This solution not only helps businesses secure their own power supply, reduce costs, and minimize dependence on the national grid, but also allows them to sell surplus electricity back to EVN.

According to research by the University of Technology – Vietnam National University Ho Chi Minh City (Journal of Materials and Construction, 2021), among 36 factors influencing solar power productivity, the five most critical include:

- Local grid compatibility

- Solar irradiance and sunlight intensity

- Government incentives (pricing, taxation, permits)

- Altitude and construction site characteristics

- Competence and experience of the EPC & O&M contractor

Now is a golden time for businesses to invest in solar power thanks to:

- Strong government support: Vietnam’s Decree 135/2024/NĐ-CP provides favorable conditions in terms of procedures, tariffs, and tax incentives for renewable energy adoption.

- Abundant solar resources: With 1,500–1,700 sunshine hours/year in the North and 2,000–2,600 hours/year in the South, Vietnam offers outstanding solar potential.

- Clear financial benefits: Long-term electricity cost savings, improved cash flow, and brand value enhancement through sustainable development commitments.

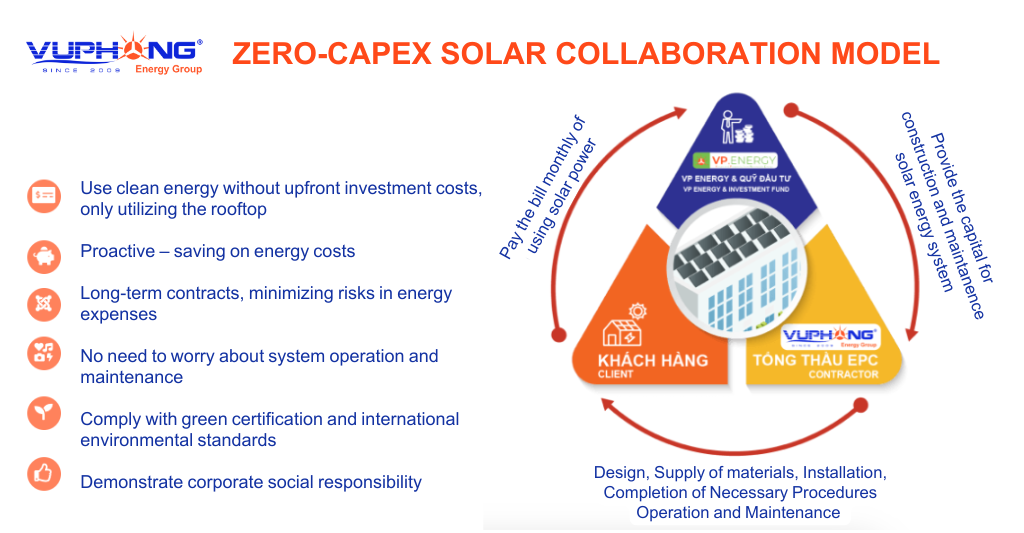

Importantly, the efficiency of any solar project largely depends on the capabilities and experience of the implementing partner. Vu Phong Energy Group is proud to be one of Vietnam’s leading renewable energy experts. Acting as developer, investor, EPC contractor, and O&M provider, Vu Phong delivers comprehensive clean energy solutions—from project development and transfer to turnkey EPC and operation. Particularly, Vu Phong pioneered the Zero CapEx Solar model in Vietnam, enabling businesses to adopt clean energy with minimal upfront investment.

Detailed Financial Analysis (ROI) and Payback Period

When businesses consider solar investment, the two most crucial factors are financial efficiency (ROI) and payback period. A 2024 case study, Developing a Financial Model for Sustainable Energy – A Case Study on Solar Power Investments, highlights that commercial & industrial (C&I) solar projects are profitable, but require significant upfront capital and long payback periods.

In the traditional CapEx model, businesses bear the full installation costs, with profits becoming significant only after several years—creating pressure on cash flow, especially for companies prioritizing capital for core operations.

The Zero CapEx Solar Model – Vu Phong Energy Group

The Zero CapEx Solar Model – Vu Phong Energy Group

This is where Vu Phong’s Zero CapEx Solar emerges as a breakthrough. Instead of investing upfront, businesses can cooperate under an Equipment Leasing Agreement (ELA). In this model, all investment costs—from design and installation to operation and maintenance—are covered by Vu Phong. Businesses only pay leasing fees for the solar system, saving money from day one without the financial burden of CapEx.

Beyond solving capital concerns, this model transfers most technical and operational risks to the provider. Vu Phong ensures system performance, carries out regular maintenance, handles incidents, and supports businesses in accessing renewable energy certificates (I-REC) to meet sustainability targets. This way, businesses reduce electricity expenses, strengthen their green brand image, and maintain capital for core business growth.

As grid electricity prices rise and clean energy demand grows, solar power is a strategic investment worth considering. And if upfront capital is the main barrier, Vu Phong’s Zero CapEx model is the smart, safe, and financially efficient key to unlocking clean energy adoption.

Long-Term and Sustainable Benefits Beyond Finance

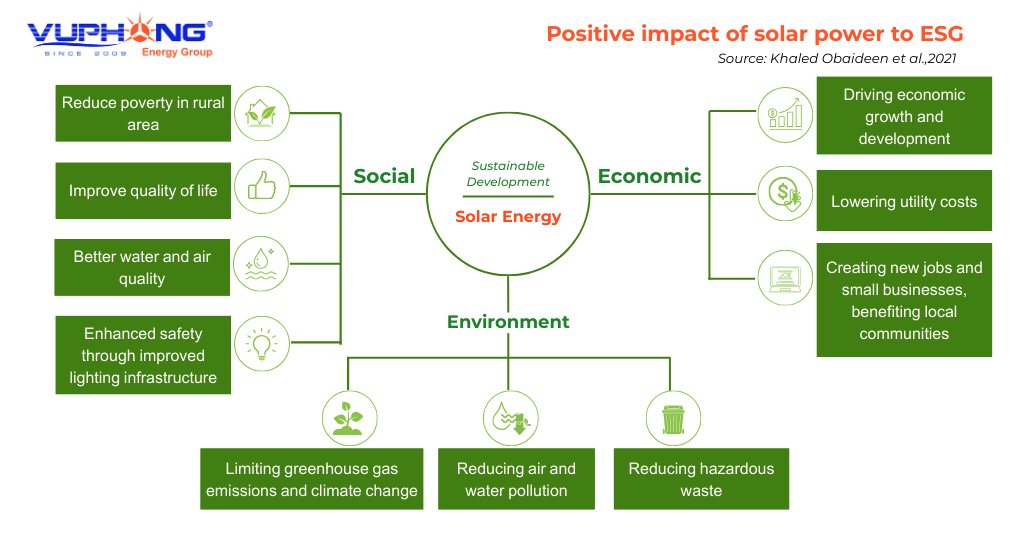

Besides financial returns, solar investment provides intangible but highly valuable benefits that contribute to a company’s holistic sustainable development.

Enhancing Brand Image and Corporate Social Responsibility (CSR)

Solar investment is not just about cost savings—it is a strategy to build a strong “green” brand in the eyes of customers and investors. According to How Renewable Energy Benefits Businesses and the Environment (2016), companies adopting renewable energy not only save on electricity bills but also leverage “green marketing” to position themselves as environmentally friendly.

Solar power positively affects to ESG objectives

Solar power positively affects to ESG objectives

In today’s context, where consumers favor socially responsible brands and investors prioritize ESG factors, adopting solar sends a powerful signal of sustainability commitment.

Strengthening Reputation with Investors and Partners

Using solar power in operations demonstrates both strategic foresight and corporate responsibility. A 2023 study by Gonçalo Oliva shows that companies with higher ESG scores attract significantly more capital from institutional and long-term investors.

A case in point is Vinamilk, which invested heavily in rooftop solar at its Vietnam Dairy Factory, with a capacity of 3.39 MWp, using 7,542 high-efficiency panels and 27 inverters (110 kW).

( Google Map)

This clean energy adoption not only optimized operations but also boosted Vinamilk’s reputation, earning prestigious ESG awards such as Leading CSR & ESG Enterprise and Outstanding CSR Enterprise in Vietnam. These recognitions reinforce Vinamilk’s sustainability commitment and competitive advantage in the dairy industry.

Reducing Carbon Emissions and Contributing to National Goals

Solar power emits only 98 g CO₂/kWh, nearly 10 times lower than coal power (955 g CO₂/kWh) (Akella, 2009), helping businesses significantly reduce their carbon footprint. By adopting solar, companies take concrete climate action aligned with Vietnam’s Net Zero 2050 commitment. This is not only a responsibility but also an opportunity to position themselves as positive contributors to the community.

Solar Power Investment – A Strategic Decision for a Sustainable Future

Rooftop solar is more than a financial solution—it enables businesses to cut electricity costs, generate positive cash flow, and unlock non-financial benefits such as enhanced brand image, energy security, and sustainable growth.

BIM2 Solar Power Project – Ninh Thuan

BIM2 Solar Power Project – Ninh Thuan

Solar power is a strategic, long-term investment that delivers sustainable value for business growth in the green energy era. Especially with innovative solutions like Vu Phong Energy’s Zero CapEx Rooftop Solar, financial barriers are removed—opening new opportunities for every enterprise.

Don’t miss the chance to turn costs into profits and secure your position as a pioneer in the clean energy era. Contact our experts today for tailored consultation and discover the solar solution best suited to your business!

Vu Phong Energy Group