In the context of increasing globalization and climate change, businesses need to focus not only on profitability but also on social and environmental responsibility. The United Nations’ Sustainable Development Goals (SDGs) and Environmental, Social, and Governance (ESG) standards are two key concepts in promoting sustainable development. While these concepts differ, they are closely linked.

Understanding SDGs and ESG

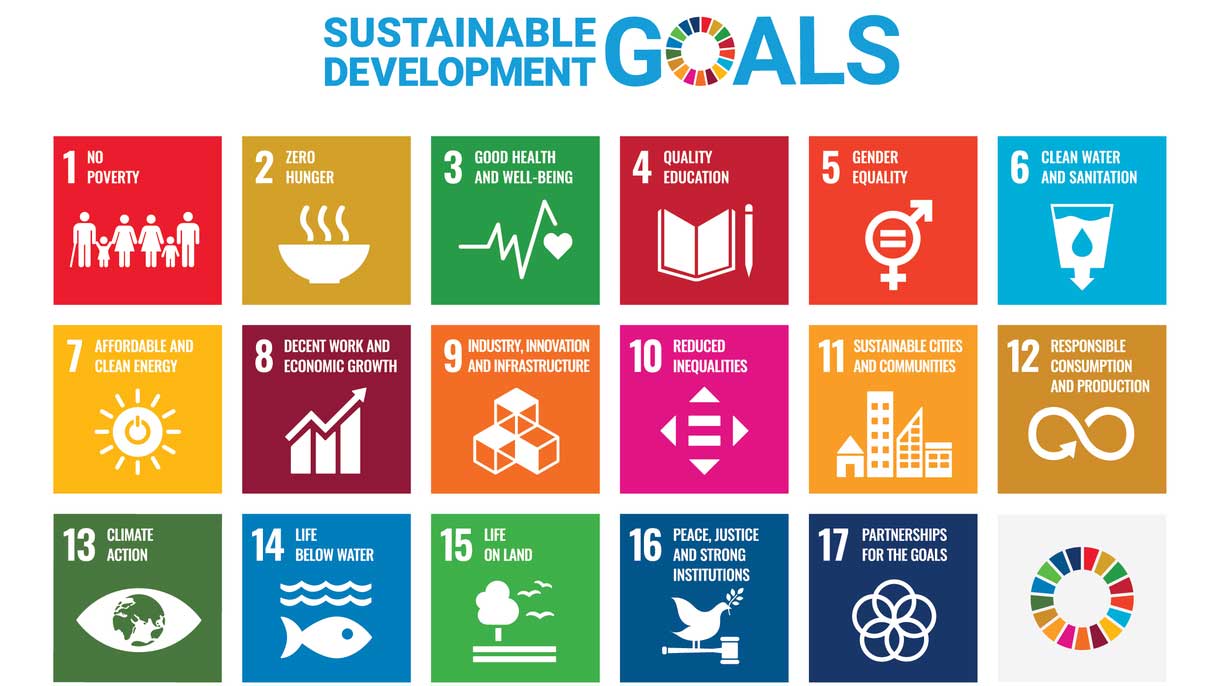

The Sustainable Development Goals (SDGs) are 17 goals established by the United Nations in 2015, aiming to address global challenges such as poverty, inequality, climate change, and environmental protection. These goals are directed at governments and call for the involvement of businesses and social organizations.

The 17 Sustainable Development Goals of The United Nations (Internet Image)

The 17 Sustainable Development Goals of The United Nations (Internet Image)

Environmental, Social, and Governance (ESG) standards are criteria that help investors assess a company’s sustainability performance. ESG focuses on three main areas:

- Environmental (E): Resource management and environmental impact.

- Social (S): Labor relations, working conditions, and community engagement.

- Governance (G): Management structure, business ethics, and legal compliance.

The United Nations Sustainable Development Goals (SDGs) are increasingly seen as essential targets and standards that encourage actions to protect the environment and the general living space of humanity. However, SDGs encompass broader topics and are not solely focused on businesses. This is where ESG frameworks—tailored to specific industries and companies—effectively adjust these broad themes. As a result, ESG serves as a framework for measuring, standardizing, and implementing specific activities for each business based on the overarching SDGs that the business initially aims to achieve.

Practical application of SDGs and ESG in Businesses

SDGs highlight key impact areas and provide a practical framework that complements and supports ESG reporting, which is now a part of fundamental research methods for investors interested in sustainable development. This helps standardize the acceptance of detailed investment decisions based on ESG and extends their influence within businesses.

For example, Dutch pension fund managers like PGGM and APG Asset Management have steadfastly developed classifications that identify areas considered Sustainable Development Investments (SDIs) and can help create market standards for such investments across 13 of the 17 SDGs.

Meanwhile, 18 Dutch financial institutions, including signatories like ABN-AMRO, Achmea Investment Management, Aegon PGGM, Rabobank, and Robeco,… have launched the Sustainable Development Initiatives (SDI) to facilitate action in four broad areas:

- Promoting SDG-themed investments through systems and deploying blended financial instruments.

- Integrating SDG-focused investments among Dutch retail investors.

- Supporting the integration and adoption of sustainability standards and indices.

- Identifying and addressing legal barriers and encouraging SDG-related investments.

Similarly, the Swedish International Development Cooperation Agency (SIDA), a government agency, has formed a partnership with 18 institutional investors, pension funds, and investment companies, known as Swedish Investors for Sustainable Development (SISD), to explore investment opportunities, related barriers, and serve as a global learning platform regarding SDGs.

Moreover, well-measured, implemented, and managed ESG reporting frameworks on the business side can help investors align their investment decisions with broader SDG goals and direct their financial resources toward SDG-related sectors.

The Sustainable Development Goals (SDGs) and the Environmental, Social, and Governance (ESG) criteria are closely linked

The Sustainable Development Goals (SDGs) and the Environmental, Social, and Governance (ESG) criteria are closely linked

Macro and micro importance & Global acceptance

The SDGs were created to establish global consensus on pressing social and environmental challenges. They allow for applying and scaling impact measurement for ESG investment strategies. Investors who strongly support the SDGs can broaden their responsible investment portfolios by seeking alignment between these goals and their investment strategies.

At the macro level, aligning SDGs with existing ESG considerations serves as a common communication framework to shape and articulate business decision-making processes and investment strategies.

At the micro level, signatories of the UN Principles for Responsible Investment (UN PRI) believe that their investments in businesses and other entities will only yield long-term profitability if those businesses are driven to contribute to developing fair and sustainable financial and social systems.

Current challenges

Successfully achieving the SDGs requires systematic changes in knowledge, skills, and institutional arrangements that serve all segments of society. This process demands considerable time, data analysis, and practical actions at both the macro (global) and micro (company/industry) levels.

A lack of data and transparency regarding the ESG performance of investment companies is often seen as a significant barrier to progressive and impactful investment decisions. Connecting ESG with SDGs is expected to help companies collect and share extensive data with investors, particularly about goals aligned with their business; it also encourages public reporting on initiatives and progress around selected SDGs using standard indicators.

Investment decisions based on ESG are geared toward creating long-term value for both the business and society. Therefore, they directly connect with the concept of ‘shared value’ within the SDGs, representing the constructive intersection of market potential, social needs, and policy action for a sustainable and inclusive approach to economic growth and well-being.

For businesses, integrating ESG factors with SDGs can simplify setting goals and aligning relevant Environmental and Social considerations (directly related) and Governance functions (often indirectly related).

SDGs offer a global set of objectives that reflect the most current definitions of sustainable development, helping businesses prioritize and strategize for sustainability. When implementing ESG, companies can use the SDGs as a guide to establish specific targets and measure effectiveness.

For example, a business aiming to improve its ESG water management score can refer to SDG 6 on clean water and sanitation. Similarly, implementing SDG 8 on decent work and economic growth can help a business meet ESG criteria related to labor conditions and labor relations.

SDGs and ESG are not merely theoretical concepts but practical tools that guide businesses toward sustainable development. Understanding and applying SDG objectives within ESG strategies not only enhances business performance but also contributes positively to society and the environment.

|

Currently, Vu Phong Energy Group and our subsidiaries, such as VP Carbon, are partnering with companies on their journey toward Net-Zero by practicing ESG, with a strong focus on the Environmental aspect through solutions like solar energy development, energy efficiency consulting, and I-REC registration and trading. Explore more about Vu Phong Energy Group’s SDGs and ESG activities at: https://vuphong.vn/sdgs-esg/. For further details, please get in touch with us via hotline: +84 9 1800 7171 or send an email to hello@vuphong.com |

Vu Phong Energy Group