“Carbon Credit” and “Carbon Offset” are often used interchangeably in discussions about carbon credits. However, these terms have distinct differences in market and exchange mechanisms. Businesses and organizations should understand these differences to view these emerging markets comprehensively. So, what exactly are these differences? Let’s explore in the following article!

Introduction to Carbon Credit and Carbon Offset

In the context of climate change and the increasing demand for sustainable development, tools like Carbon Credit and Carbon Offset are becoming crucial in reducing greenhouse gas emissions. These are not only financial mechanisms to help businesses comply with environmental regulations but also ways for companies to demonstrate social responsibility.

Carbon Credit: This type of emission permit allows a business to emit a certain amount of greenhouse gases within a specified period. Governments or international organizations typically issue it through cap-and-trade programs.

Carbon Offset: These are certificates created when a unit or project reduces or removes greenhouse gas emissions from the atmosphere. Carbon Offsets are usually bought and sold voluntarily by businesses to compensate for their emissions.

The different mechanisms of Carbon Credit and Carbon Offset

Mechanism of Carbon Credit: Also known as “carbon allowances,” Carbon Credits function as emission permits. When businesses buy a Carbon Credit, they can emit one ton of CO2 or an equivalent amount of greenhouse gases. National governments or international organizations typically issue Carbon Credits as part of cap-and-trade programs. An emission cap is set in these programs, and businesses must purchase credits to emit within that limit. If a business does not use all of its credits, it can sell the excess on the market.

Mechanism of Carbon Offset: Unlike Carbon Credits, Carbon Offsets operate more voluntarily. Carbon Offsets are usually generated by emission reduction projects such as renewable energy, reforestation, or carbon capture initiatives. When a business buys a Carbon Offset, it reduces its greenhouse gas emissions and contributes to environmentally beneficial projects.

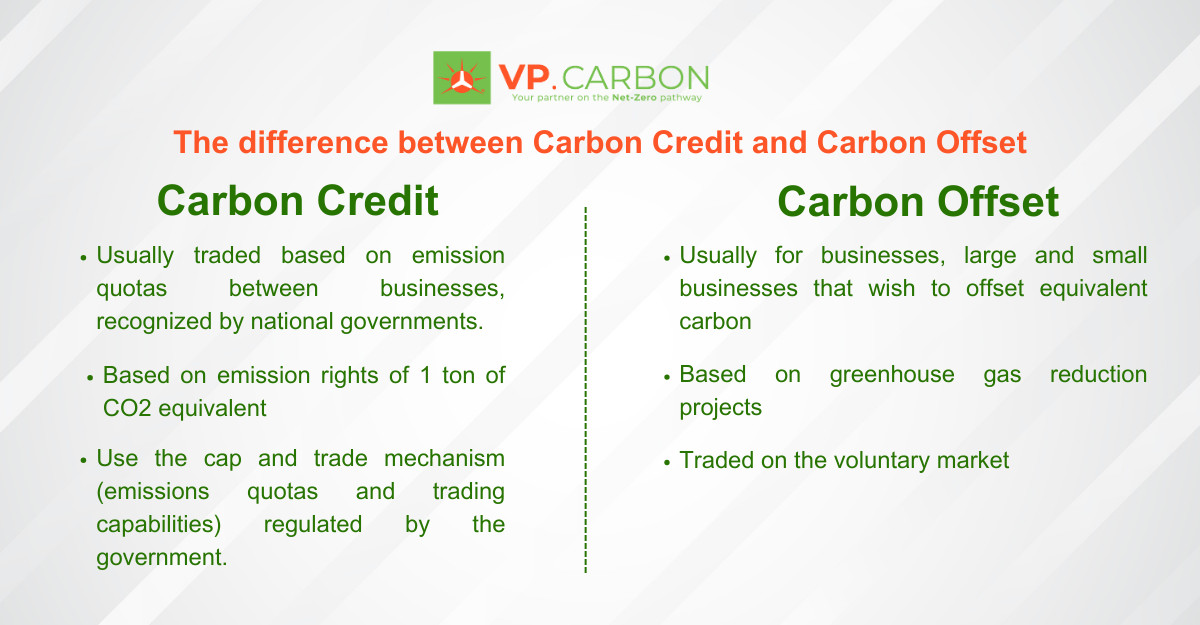

Summarize the difference between Carbon Credit and Carbon Offset

Summarize the difference between Carbon Credit and Carbon Offset

Current Carbon Market

Compliance market: These are markets regulated by government or intergovernmental organizations. Businesses must strictly adhere to set emission limits and purchase Carbon Credits to meet these requirements. Examples include California’s cap-and-trade program and the European Union Emissions Trading System (EU ETS).

Voluntary market: This market is where businesses and individuals purchase Carbon Offsets to compensate for their emissions without legal obligations. It often attracts organizations and businesses with a high sense of social responsibility and a commitment to environmental protection.

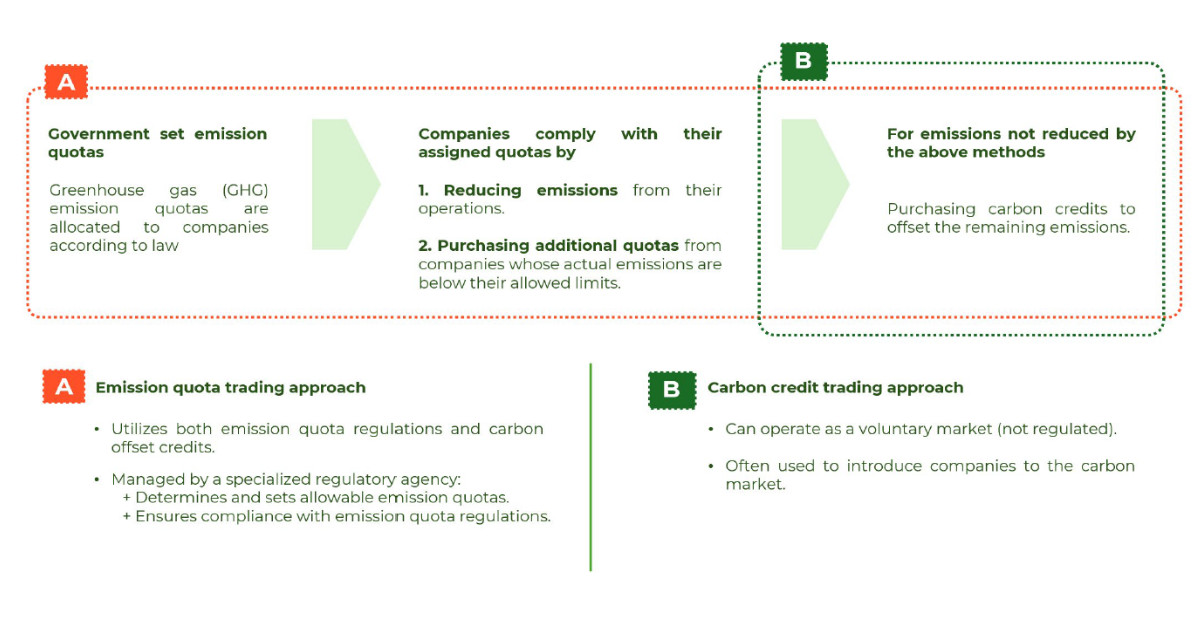

Currently, these two markets can develop harmoniously. Regulatory bodies set emission quotas for businesses. Companies comply with these quotas by reducing emissions and purchasing additional allowances from companies with emissions below the permitted level (compliance market). If companies have implemented emission reduction solutions and quota exchanges but do not meet the allowable emissions, they will trade carbon credits in the voluntary market.

Approach to harmonize the two carbon credit markets

Approach to harmonize the two carbon credit markets

Opportunities and challenges in Carbon markets

Benefits of participating in the Carbon market: Participation in carbon markets brings many benefits, such as improving corporate reputation, attracting investment, and minimizing environmental risks. Companies can use carbon credits to comply with legal regulations and achieve sustainable development goals.

Vietnam has received a payment of USD 51.5 million for verified emission reduction results (carbon credits) due to efforts to reduce deforestation and forest degradation (REDD+) and enhance carbon storage through reforestation and afforestation. It is the first country in the East Asia-Pacific region to receive payment based on emission reduction results from the World Bank’s Forest Carbon Partnership Facility (FCPF).

Challenges and limitations: Some challenges include diversifying and managing emission reduction projects, high transaction costs, and adhering to strict standards. Additionally, identifying appropriate methodologies for inventorying each type of emission activity accepted by international organizations and re-evaluating the reduced emissions from reduction initiatives. Moreover, translating specialized terms can lead to differences in understanding between parties.

Vu Phong Energy Group