The carbon credit market is emerging as a critical component in the global effort to mitigate greenhouse gas emissions. This market is experiencing a significant uptick in activity, characterized by an increase in both the number and diversity of trading exchanges and institutions. As we delve deeper into this article, we will explore a range of intriguing details about carbon credits, including their role, regulation, and the nuances of the trading process that make this market a unique and vital part of our environmental strategies. This article will unveil some compelling insights into the world of carbon credits and their vibrant trading ecosystem.

- The journey to The Net Zerogoal requires a breakthrough

- COP26: Joint voice to protect the future of the Earth

What is a carbon credit?

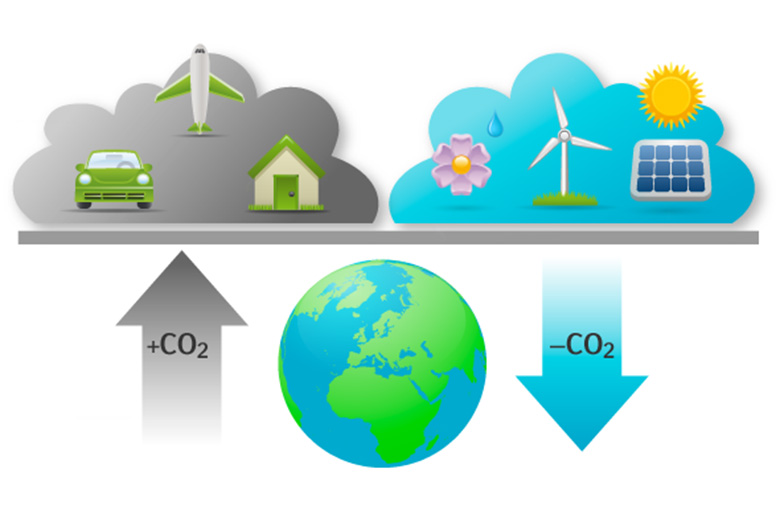

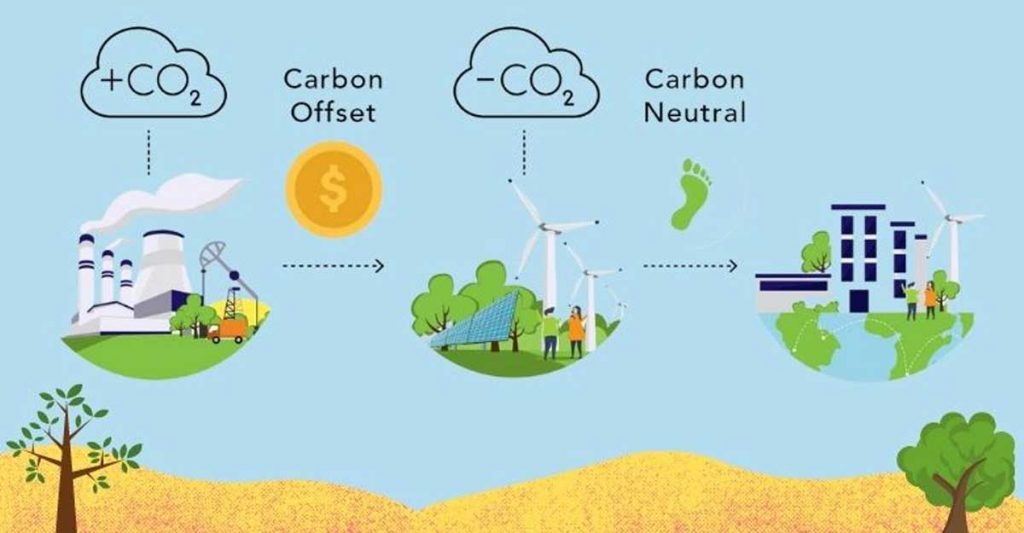

A carbon credit embodies the certification granted to an individual or organization for reducing greenhouse gas emissions by one metric ton of carbon dioxide, or its equivalent in other gases (tCO2e). These credits are a key element in the environmental market, allowing for the trading of emission allowances, effectively setting a cap on the total amount of greenhouse gases that can be emitted while providing economic incentives for achieving reductions in the emissions of pollutants.

The historical development of the carbon market

The carbon market is rooted in the Kyoto Protocol on Climate Change, which the United Nations adopted in 1997. Excess emissions rights are sold to or acquired from nations that emit more or less than the committed target under the Kyoto Protocol. Since then, the world has added a new commodity: the credit duction/absorption of greenhouse gas emissions. Because carbon (CO2) is the greenhouse gas equivalent of all other greenhouse gases, the transactions are referred to as carbon trade and exchange, resulting in forming a carbon market or carbon credit market.

There are two types of carbon markets: mandatory and voluntary carbon markets

The carbon market has developed in European, American, and Asian countries since the Kyoto Protocol. Markets are categorized into two categories:

- Mandatory carbon market/mandatory market: a market in which carbon trading is based on nations’ commitments to meet their greenhouse gas reduction objectives under the United Nations Framework Convention on Climate Change (UNFCCC). This market is required and primarily for projects under the Clean Development Mechanism (CDM), the Sustainable Development Mechanism (SDM), or the Joint Implementation (JI).

- Voluntary carbon market/Voluntary market: bilateral or multilateral agreements between organizations, enterprises, or countries. Credit purchasers participate in transactions voluntarily to meet environmental, social, and governance (ESG) policies and reduce carbon emissions.

The world’s major carbon markets

The European Union established the first international carbon trading market in 2005. This is the European Union’s most significant policy tool for responding to climate change and implementing commitments made in the former Kyoto Protocol and, later, the Paris Agreement on Climate Change. This market accounts for around 45% of total European emissions and approximately three-quarters of the global carbon emissions.

- Operation and maintenance for wind power: “billion-dollar” market

- Check it out: 3 Asset Management packages add value to wind farms

China first mentioned building a carbon market in its Socio-Economic Development Plan for the period 2011-2015 and then undertook a large-scale trial in regions and cities with varying economic levels. China’s carbon exchange trading market officially began on July 16, 2021, with the Carbon neutrality goal by 2060.

Internet Photo

Vietnam: Pilot operation of a carbon credit exchange from 2025

The Government enacted Decree No. 06/2022/ND-CP on January 7, 2022, regulating greenhouse gas emissions and ozone layer protection. This Decree contains precise regulations on the development roadmap and the timing for launching the domestic carbon market. From now until the end of 2027, Regulations will be developed for the administration of carbon credits, the exchange of greenhouse gas emission quotas and carbon credits, and the operation of carbon credit trading floors; Implement a pilot mechanism for carbon credit exchange and clearing in potential areas, and guide the implementation of the domestic and international carbon credit exchange and clearing mechanism by laws and regulations international conventions to which the Socialist Republic of Vietnam has signed; From 2025, establishing and organizing a pilot operation of a carbon credit exchange; Implement actions to build capacity and create awareness about the development of carbon markets.

Organize an official carbon credit exchange in 2028; Regulate activities to connect and trade domestic carbon credits with regional and world carbon markets beginning in 2028.

|

Vu Phong Energy Group will join the carbon credit market On November 25, 2021, Vu Phong Energy Group, C47, and INTRACO signed a Memorandum of Understanding (MOU) on “Providing clean drinking water stations and reducing greenhouse gas emissions projects”. The cooperation towards establishing a joint venture to produce, build, install and operate water purification stations that provide drinking water, improve community health. The project aims to build and install 1,000 water purification stations per year in various provinces and cities, each with a 2,000-liter-per-hour capacity to ensure equitable access to water and sanitation. Following that, the project will be able to extend into the fields of afforestation and marine ecosystems protection. By creating projects under the Sustainable Development Mechanism (SDM), the program will generate revenue from carbon credits, in addition to community benefits, and will contribute to the realization of The Sustainable Development Goals, particularly in water security. |

Vũ Phong Energy Group