Carbon pricing is an essential instrument for reducing greenhouse gas emissions. Carbon pricing has many forms, including carbon taxes, emissions trading system (ETS); internal carbon pricing (ICP); offset mechanisms of carbon credits… etc.

Here is some interesting carbon pricing information, updated with data from the World Bank’s “State and Trends of Carbon Pricing 2022” report.

USD 84 billion in revenue

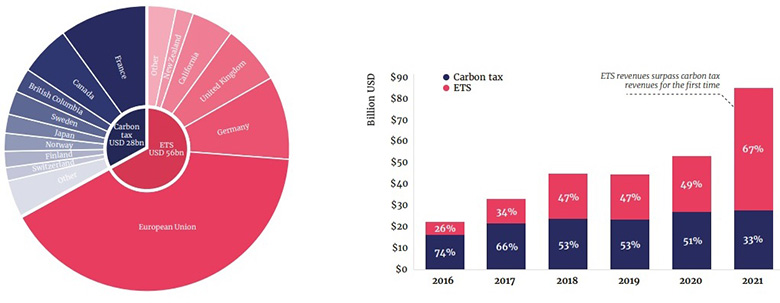

Global carbon pricing revenue in 2021 established a record of over USD84 billion, an increase of approximately USD 31 billion over 2020 – an increase of almost 60%. Higher carbon prices drove revenue growth, particularly in the European Union Emissions Trading System (EU-ETS), which accounts for around 41% of total global carbon pricing revenue, and the New Zealand ETS and the California Cap-and-Trade Program. Prices in carbon taxes and ETS have reached new records in many jurisdictions, driven by ambitious climate policies and economic factors such as energy prices.

In particular, revenue from ETS surpassed revenue from carbon taxes for the first time in 2021, accounting for 67 percent of total global carbon pricing revenue. It demonstrates a rapid growth in the value and share of ETS. ETS revenue accounted for 26 percent of total carbon pricing revenue in 2016, increasing to 34 percent in 2017, 47 percent in 2018-2019, and equivalent share to a carbon tax (reaching 49 percent) in 2020.

Carbon pricing instrument revenue in 2021, as well as the development of global carbon pricing revenue over time (Image source: World Bank)

Carbon pricing instrument revenue in 2021, as well as the development of global carbon pricing revenue over time (Image source: World Bank)

Carbon credits based on emissions reductions (such as carbon capture and afforestation) price USD 19/credit as of March 2022, a 48 percent increase over the previous six months. Emissions reduction or avoidance credits are less expensive, costing just around 40% of this price.

The carbon tax rates also increased in 2021 and early 2022, by an average of USD 6/ton in 2021 and an additional USD 5/ton starting April 20, 2022. Most observed price increases are due to planned changes or adjusted rates. Several jurisdictions have likewise set more ambitious price trajectories for the future years. Singapore, for example, intends to progressively increase the carbon tax rate from SGD 5 (Singapore dollars) to SGD 25/ton (USD 18/ton) in 2024-2025, 45 SGD (USD 33/ton) in 2026-2027, and SGD 50-80 (USD 37-59/ton) in 2030.

The significant increase in carbon pricing revenue demonstrates the tool’s potential for development. It also highlights the significance of carbon pricing as a financial instrument to help achieve larger policy objectives, such as post-pandemic recovery, assisting vulnerable sectors and communities in adapting to climate impacts, and achieving just transitions.

However, the carbon price remains far below the amount necessary to reach the Paris Agreement’s climate targets. Carbon prices must be in the USD 50-100/ton range to keep the average global temperature increase below 2 degrees Celsius. Meanwhile, to reach net-zero emissions by 2050 – the milestone for limiting global temperature rise to 1.5 degrees Celsius – it is estimated that the carbon price needed is in the range of USD 50-250/ton, with the average being USD 100/ton.

68 carbon pricing instruments (CPIs)

There are 68 CPIs operating throughout the globe as of April 2022, with three more planned. Carbon pricing accounts for around 23% of total global greenhouse gas emissions.

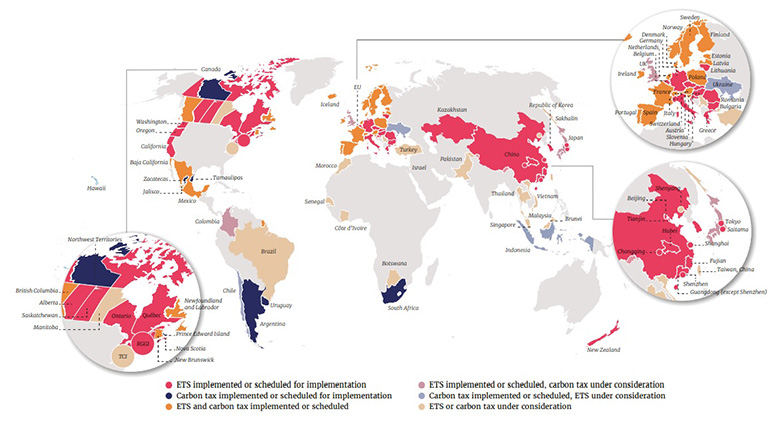

In the past year (May 2021 to May 2022), a new carbon tax (in Uruguay) and three new ETSs (in Oregon, New Brunswick, and Ontario) have been operated. Carbon pricing instruments are also scheduled for implementation in Indonesia, Austria, and Washington (USA). Other nations and regions, such as Israel, Malaysia, and Botswana, have announced their intention to develop carbon pricing, while Vietnam has outlined a plan to set up an ETS. Several additional jurisdictions in Africa, Central Europe, and Asia are also evaluating the potential of implementing carbon pricing.

Global map of carbon taxes and ETSs

Global map of carbon taxes and ETSs

(Image source: World Bank, Vietnamization: Vu Phong Energy Group)

Voluntary carbon market: surpassing 1 billion USD

In 2021, the carbon credit markets increased by 48%. For the first time, the total value of the voluntary carbon market surpassed one billion USD (November 2021). The volume of carbon credits traded on the voluntary market exceeded 362 million credits, representing a more than 92 percent increase over 2020. The main driver of the voluntary carbon market is corporate environmental goals, as corporations commit to decarbonizing the value chain and achieving net-zero emissions. The Glasgow Financial Alliance for Net Zero (GFANZ), which includes over 450 banks, insurers, and investors worldwide committed to addressing climate change in their operations, reinforces this trend.

Carbon credit demand is forecasted to grow 15-fold by 2030, to 1.5-2 GtCO2 per year, and 100-fold by 2050, to 7-13 GtCO2.

Internal carbon pricing: USD 0.8-6,000/ton

Companies are becoming more interested in implementing an internal carbon pricing mechanism. Companies that go public with a CDP in 2021 report that 16 percent have implemented internal carbon pricing, and 19 percent plan to implement such a price in the following two years. The number of reports using internal carbon pricing increased by 16 percent in both 2020 and 2021.

Internal carbon pricing is reported to be USD 0.8-6,000/ton, but most of it remains below $50-100/ton – the economists believe the price is needed to meet the Paris Agreement’s goals. Approximately 950 companies have disclosed their internal carbon pricing to CDPs, with 68 percent charging USD 50/ton or less and 18 percent charging USD 50-100/ton. Less than 100 companies charge more than USD 100 per ton.

Vu Phong Energy Group