Green bonds have been in the market for more than 12 years and are likely to be officially issued in Vietnam this year. It is seen as a critical driver of sustainable growth, particularly in the clean energy industry.

What exactly are green bonds?

There is no universal definition of green bonds, but there is agreement among international organizations on what they mean:

Green bonds are bonds issued by governments, banks, municipalities, or enterprises to obtain funds for climate change solutions, according to the Climate Bonds Initiative (CBI).

According to the International Capital Markets Association (ICMA), green bonds allow for capital raising and investment in new and current projects with environmental benefits.

According to the World Bank (WB), Green bonds help nations expand and develop climate and low-carbon resilience, including climate change mitigation and adaptation.

Green bonds, like ordinary bonds, are a fixed-rate financial instrument used to raise funds from investors through the capital market. On the other hand, green bonds are branded “green” by the issuer and relevant authorities. As a result, the issuer agrees to use the proceeds transparently, specifically to finance or refinance “green” projects, assets, or business operations that benefit the environment. Furthermore, green bonds include various particular conditions about debt repayment and recourse/exemption from alternatives to the issuer.

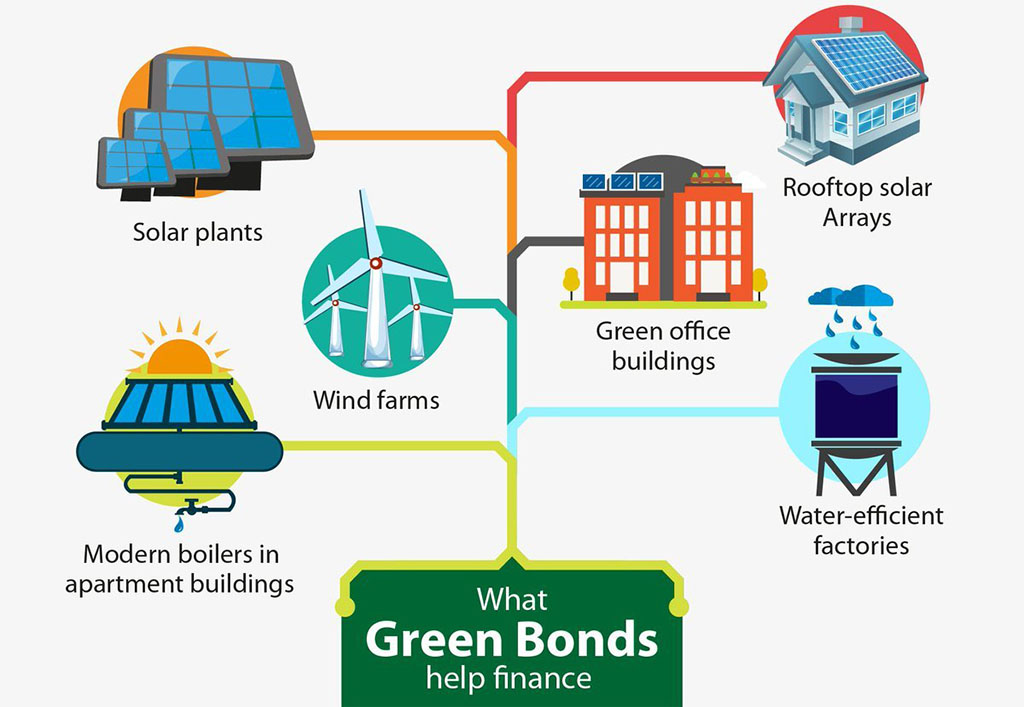

According to CBI, bond proceeds are used to fund green projects in general, including the following categories: (1) Energy; (2) Building; (3) Traffic; (4) Water management; (5) Waste management and pollution control; (6) Nature-based assets such as land use, agriculture, and forestry; (7) Energy-intensive industry and commerce; and (8) Information and communication technology (ICT).

What Green Bonds help finance (Source: Internet)

Green projects, according to the ASEAN Green Bond Standards, are all projects that benefit the environment, including (1) Renewable energy; (2) Energy efficiency; (3) Prevention and control of pollution; (4) Management of environmental sustainability in land use and natural habitats; (5) Conservation of terrestrial and aquatic biodiversity; (6) Clean traffic; (7) Sustainable water and wastewater management; (8) Adaptation to climate change; (9) Production process and technology adapted to efficient economy; (10) Green buildings are certified or meet recognized international, national and regional standards.

A revolution in capital markets

The official issuance of green bonds by the World Bank (WB) in November 2008 laid the groundwork for the formation and development of the green bond market today. Since then, green bonds are believed to have ushered in a revolution in the capital market toward sustainability: from a market in which investors know little and care little about what their investment money is used for to a market; and in which the intended use of capital becomes the primary concern.

The interest of investors in the purpose of cash flow signals a fundamental shift in the bond market. They realize the power of supporting climate solutions while still doing business. Bondholders have helped to climate adaptation, food security, public health, the nation’s energy supply, and other areas by investing in green bonds while encouraging direct investment in “greening” brown economic sectors and activities with a social impact. Green bonds, of course, offer additional benefits to investors, such as meeting Environmental, Social, and Governance (ESG) requirements for sustainability investment mandates, minimizing climate change-related risks in a portfolio…

The driving of the clean energy industry and sustainable development

The growth of the green bond market, in particular, and the labeled bond market, has attracted a large number of international investors. Even though the world faces numerous issues as a result of the COVID-19 epidemic, demand for green bonds remains robust. The entire value of green bond issuance is expected to reach 375 billion USD in 2021.

This is regarded as an effective method of mobilizing private-sector funding for clean energy projects in particular and initiatives beneficial to the environment and society in general to achieve development goals such as sustainability and the 2015 Paris Climate Agreement.

Many governments, banks, financial institutions, and businesses have employed green bonds to boost the renewable energy industry and ecologically friendly projects. The markets with the most issued green bonds are the United States, China, and France. Many energy companies in the ASEAN region have also used green bonds. For example, B.Grimm issued 5 billion Thai baht ($155 million) in green bonds with a 5-year term in 2018 to pursue a goal to boost the share of renewable energy output in the investment portfolio from 10% to 30% by 2021. Bond proceeds will fund and refinance seven new solar power facilities and nine existing solar power facilities in Thailand.

According to the draft Power Planning VIII (National electricity development planning period 2021-2030, vision to 2045), the total investment in electricity development in Vietnam in the 2021-2030 period is approximately 128.3 billion USD, with 95.4 billion USD for the power source and about 32.9 billion USD for the grid. Each year, around 12.8 billion USD must be invested. In which the state’s capital investment accounts for only approximately 20%. Suppose the “financial leverage” of green bonds is effectively utilized. In that case, this will be a significant driving factor for developing clean energy in Vietnam and the energy industry in general. Meanwhile, interest rates in established economies are at an all-time low, providing an exceptional opportunity for emerging nations like Vietnam to attract international green bond inflows.

This year, green bonds are likely to be officially introduced into the Vietnamese market. The State Securities Commission recently collaborated with the International Financial Organization (IFC) to host a conference to guide the issuing of this bond’s form, launching the Guidebook for Green Bonds, social bonds, and bonds. When the green bond market matures, it will encourage green growth while providing investors interested in sustainable development with a new cash flow route.

Click here to read more about news

Click here to read more about Wind energy development

Source: Vu Phong Energy Group JSC